Sep 17 2019 | Ray White

What 12+ Months Of Ray White Auction Data Tells Us About Today’s Residential Real Estate Market

Ray White call’s over 20% of auctions in Australia, and our Auctions Reporting system gives us up to the day information on sales at a national and local level.

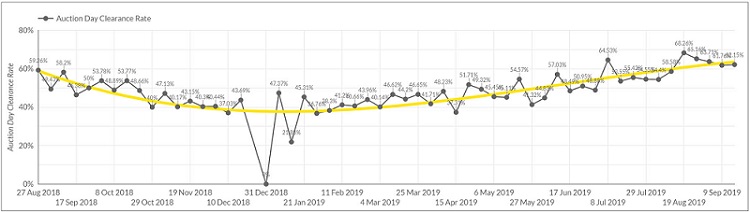

Auction day clearance rates are recovering across the nation to August 2018 levels

Despite the improved clearance rates, supply of stock remains a struggle. Is this because sellers don’t believe the recovery is truly occurring? Or is it because some buyers still remain in the red and hence are reluctant to sell? Has the decline in interest rates only delayed the inevitable?

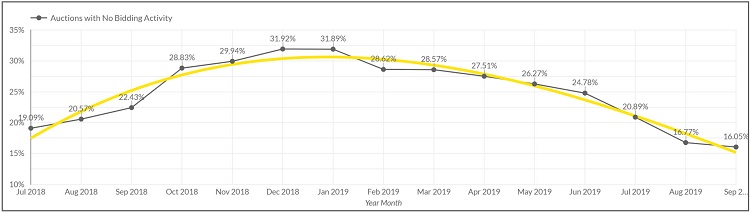

Auction with no Bidding Activity

Auctions with no bidding activity are in opposition to season trends; bidding activity has been increasing during winter when it normally slumps; and was weak in summer when bidding activity is conventionally strong.

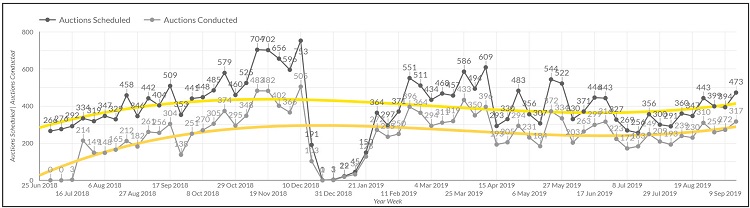

Auctions Scheduled vs Auctions Conducted

It’s no surprise that as clearance rates improve the numbers withdrawing from auction declines. See the gap between the blue and red lines: the thinner the gap the better, its shows us that sellers are meeting the market.

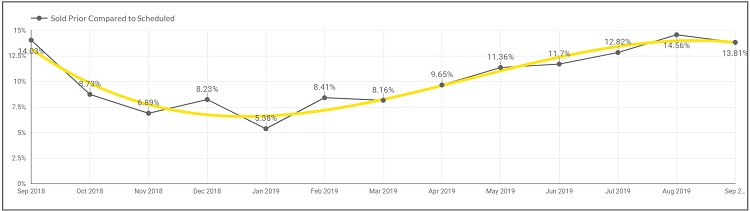

Sold Prior: Compared to Scheduled

Okay, so this is an interesting one. Generally when things improve, sellers tend to go to auction because they have confidence. But this graph shows us something different. More sellers are selling before auction, yet clearance rates are improving…this is not the norm.

Ultimately while we see things improving, our statistics are showing that some sellers just don’t believe in the recovery. As we head into our prime spring season, it will be curious to see what the data spits out. Stay tuned.