Western Sydney Portfolio Refinance

Double Bay

Oxley Ridge

Property

Industrial and Residential Masterplan Estate

Mixed-use, Residential

Residential Masterplan Estate

Location

Badgerys Creek & Cobbitty, Sydney

Double Bay, Sydney

Cobbitty, Sydney

Loan Size

$827 million

$25 million

$100 million

Peak LVR

80%

67%

67%

Term

21 months

39 months

27 months

Investment Thesis

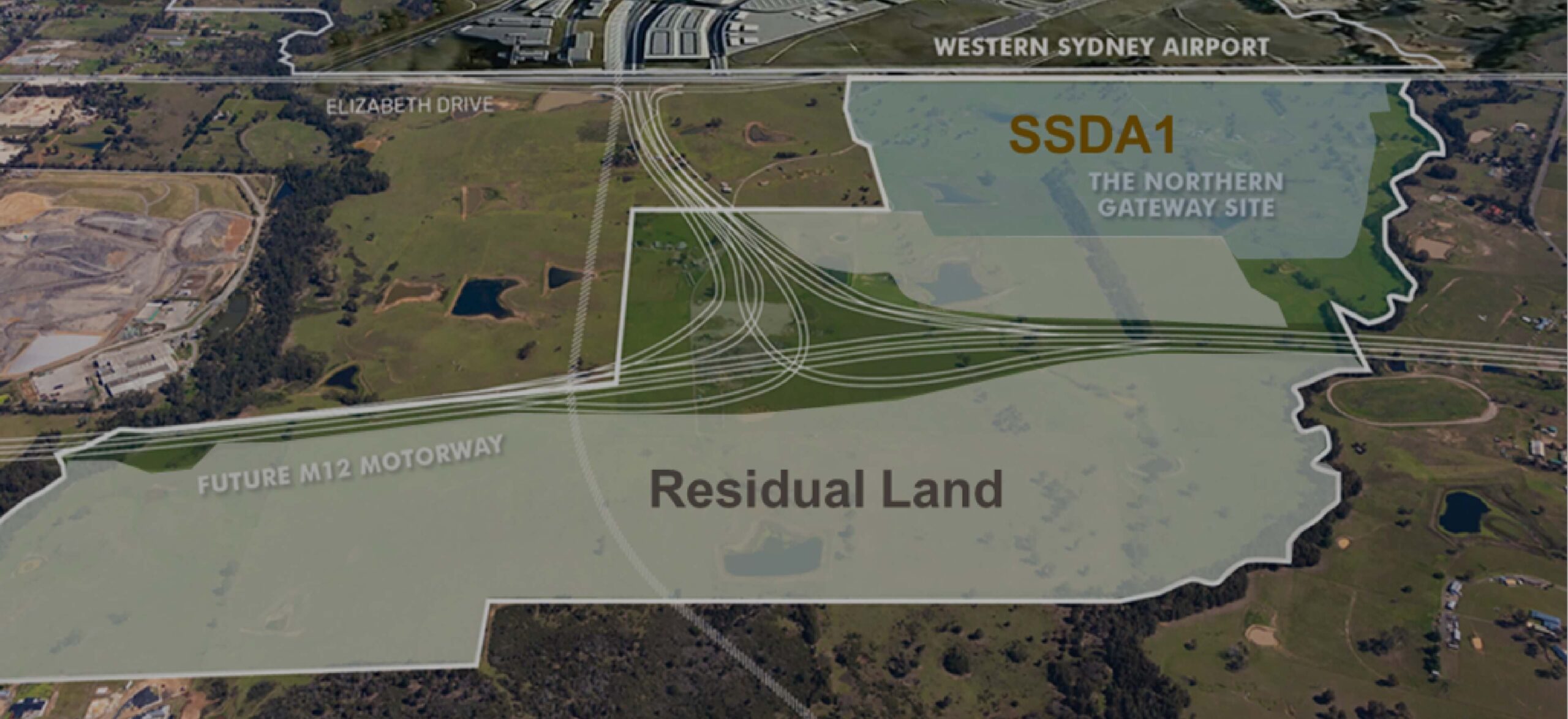

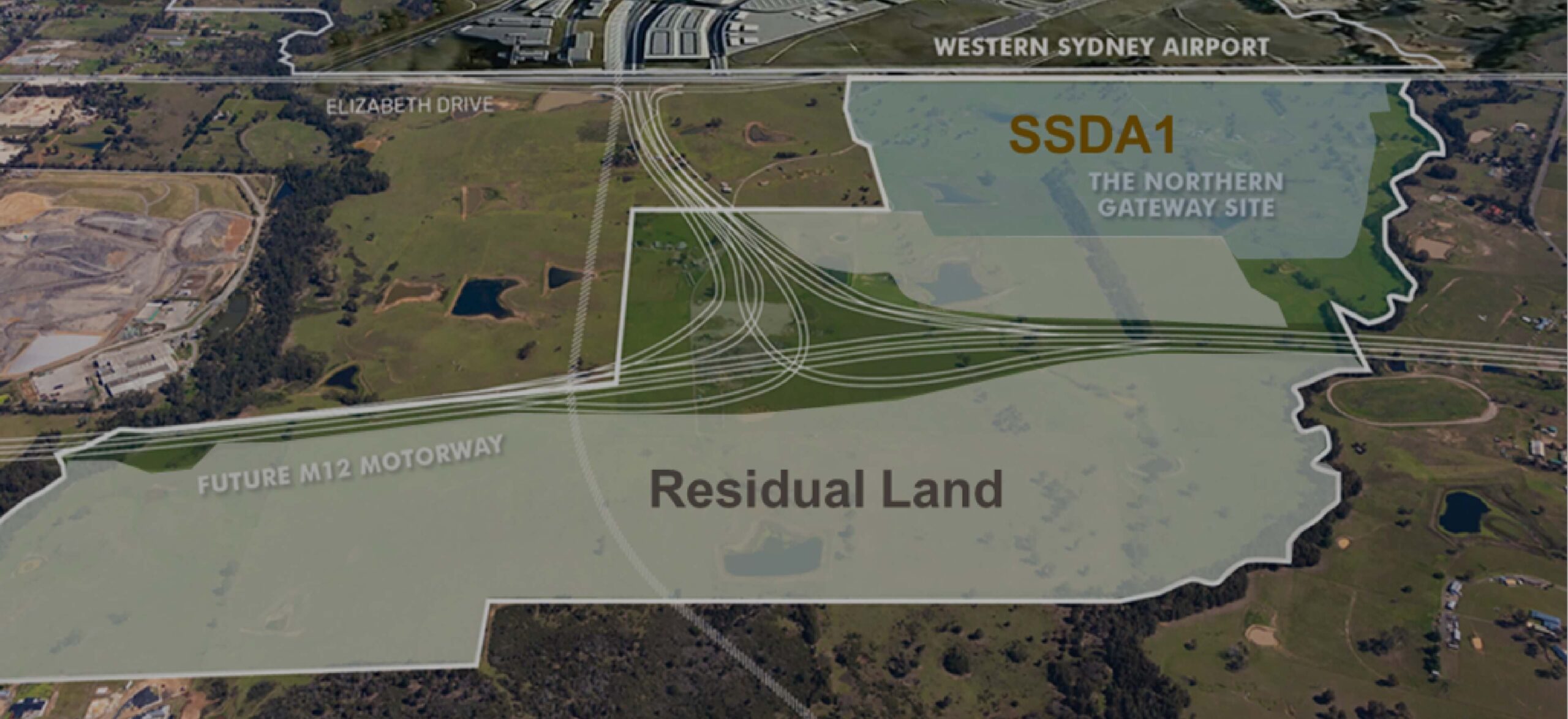

- Strategic land holding located directly opposite the new Western Sydney Airport (Badgerys Creek)

- RW Capital had strong conviction on demand for industrial and residential property in this area

- Strong conviction on downsizer market given significant wealth generation in the Sydney market on the back of property price increases

- Experienced developer with additional sites located adjacent to the subject property

- Demand for new housing in Sydney’s South West corridor driven by infrastructure investment (new Western Sydney airport, business park, rail and roads)

- Facility had conversion feature which facilitated paydowns and the step up of returns as part of debt becomes second mortgages behind a construction bank once 100% presales cover is achieved

RW Capital Value-Add

- The deal was highly complex due to its size (one of the largest land bridge facilities ever completed in Australia), and multi-faceted planning approvals

- RW Capital formed a highly complicated lending syndicate, and managed both the syndicate and the borrower to deliver a positive exit

- Proprietary Ray White data gave RW Capital the ability to provide funding during COVID-19 when other lenders had pulled out of the market

- Created a highly complicated syndicate with both foreign and domestic institutional investors

- RW Capital’s creative structuring ability differentiated it from other financiers, which allowed for the conversion of the debt (from senior to junior) in stages as the project progressed

Western Sydney Portfolio Refinance

Property

Industrial and Residential Masterplan Estate

Location

Badgerys Creek & Cobbitty, Sydney

Loan Size

$827 million

Peak LVR

80%

Term

21 months

Investment Thesis

- Strategic land holding located directly opposite the new Western Sydney Airport (Badgerys Creek)

- RW Capital had strong conviction on demand for industrial and residential property in this area

RW Capital Value-Add

- The deal was highly complex due to its size (one of the largest land bridge facilities ever completed in Australia), and multi-faceted planning approvals

- RW Capital formed a highly complicated lending syndicate, and managed both the syndicate and the borrower to deliver a positive exit

Double Bay

Property

Mixed-use, Residential

Location

Double Bay, Sydney

Loan Size

$25 million

Peak LVR

67%

Term

39 months

Investment Thesis

- Strong conviction on downsizer market given significant wealth generation in the Sydney market on the back of property price increases

- Experienced developer with additional sites located adjacent to the subject property

RW Capital Value-Add

- Proprietary Ray White data gave RW Capital the ability to provide funding during COVID-19 when other lenders had pulled out of the market

Oxley Ridge

Property

Residential Masterplan Estate

Location

Cobbitty, Sydney

Loan Size

$100 million

Peak LVR

67%

Term

27 months

Investment Thesis

- Demand for new housing in Sydney’s South West corridor driven by infrastructure investment (new Western Sydney airport, business park, rail and roads)

- Facility had conversion feature which facilitated paydowns and the step up of returns as part of debt becomes second mortgages behind a construction bank once 100% presales cover is achieved

RW Capital Value-Add

- Created a highly complicated syndicate with both foreign and domestic institutional investors

- RW Capital’s creative structuring ability differentiated it from other financiers, which allowed for the conversion of the debt (from senior to junior) in stages as the project progressed